Registered Investment Advisor

RIAs act in your best interest, following strict fiduciary standards to protect you and your money.

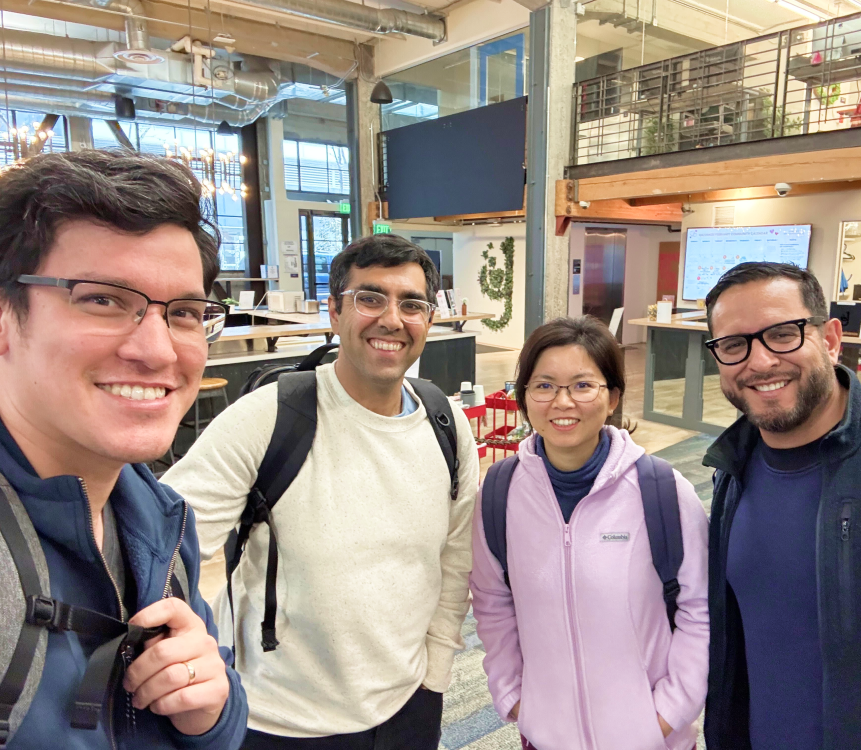

We built Enrich Finance after struggling with navigating the same messy mix of accounts, stock options, RSU, 401Ks, Roth IRAs, 529s, and goals that you face. What started as a way to make sense of our own finances has become a tool to help others see the big picture clearly and make smarter decisions with confidence.

.png)

The 2008 crisis showed me that real investing success comes from managing the whole picture — defining a clear asset allocation strategy — not just picking stocks. However, as my own finances became more complex with multiple accounts, RSUs, and crypto, I realized that even the most intelligent strategies were challenging to manage in practice. Friends were feeling the same pain. I knew we all needed better tools.

The 2008 crisis showed me that real investing success comes from managing the whole picture — defining a clear asset allocation strategy — not just picking stocks. However, as my own finances became more complex with multiple accounts, RSUs, and crypto, I realized that even the most intelligent strategies were challenging to manage in practice. Friends were feeling the same pain. I knew we all needed better tools.

We act in your best interest, following strict fiduciary standards to protect you and your money.

Your data stays safe—our systems are designed and audited for top-tier privacy and security.

Our founder has rigorous, financial planning knowledge—so guidance is never guesswork.

We’ve created secure, high-scale tech and financial tools used by millions at companies like Amazon, Google and Facebook - and FinTechs like SnapDocs.

RIAs act in your best interest, following strict fiduciary standards to protect you and your money.

Your data stays safe—our systems are designed to prevent privacy and security threats and independently audited.

Our founder has rigorous, financial planning knowledge—so guidance is never guesswork.

We’ve created secure, high-scale tech and financial tools used by millions at companies like Amazon, Google and Facebook - and FinTechs like SnapDocs.

We built Enrich for people like us: those with complex financial lives who want real control, not another robo‑advisor or commission-driven firm. We keep your money where it already lives—no forced transfers, no hidden agendas.

We’re a bootstrapped, mission-driven team with deep experience in fintech, big data, consumer apps, UX, and security, building sustainable tools—not chasing VC returns. Every team member talks directly with customers, so our features solve real problems. When our early users needed more control during rebalancing, we shipped a solution in hours—not months.

You pay $50/year, flat. No AUM fees No front-running trades. No surprises. Just powerful, trustworthy tools that put you in charge.

Drop us a line anytime. We love a good money question.

Weekdays, 8am–5pm. Real humans, real help.

Swing by and say hi—coffee’s on us.

Drop us a line anytime. We love a good money question.

Weekdays, 8am–5pm. Real humans, real help.

Swing by and say hi—coffee’s on us.